In the ongoing landscape of sustainable energy solutions, the key role played by high-quality batteries cannot be understated. As the world undergoes a profound shift towards cleaner and more efficient technologies, batteries have emerged as the linchpin supporting the widespread adoption of electric vehicles, renewable energy storage, and portable electronic devices. However, the journey from raw material extraction to end-of-life disposal presents a complex web of challenges and opportunities. Ensuring the quality and reliability of batteries throughout this intricate value chain is not only a business imperative but also a fundamental commitment to building trust in sustainable energy solutions.

According to analysts, global demand should grow by around 30% by 2030 and the battery value chain will grow tenfold between 2020 and 2030. Yet, this demand gap between consumers and production place considerable pressure on lithium-ion battery ecosystem. All EV markets today rely heavily on lithium-ion battery packs making the shift to such a vast ecosystem a challenge.

So how to secure and maintain the quality of batteries through the value chain?

This article delves into the multifaceted challenge of securing and maintaining battery quality throughout the entire value chain. As businesses navigate the complexities of global supply chains, manufacturing processes, and customer usage patterns, the pursuit of excellence in battery production becomes a strategic imperative. This comprehensive overview will unravel the key considerations and best practices that businesses can adopt to not only meet the stringent demands of quality but to also foster a resilient and sustainable ecosystem for batteries. From raw material sourcing to end-of-life considerations, the following insights provide a roadmap for businesses seeking to fortify their position in this very competitive market.

Key pain points faced by battery manufacturers and suppliers that create volatility of the value chain

A fragile and fragmented supply chain

“The electric vehicle battery supply chain is complex, multifaceted and fragile. It consists of a multi-stage in which several players and parts are strongly interdependent. The difficulty of the supply chain is first fueled by the scattering around the world and the concentration in just a few regions. Although several automakers and suppliers are either involved in multiple stages or evolving from scratch” analyzes Augustin Brochot, EVP Innovation & Strategic Ventures at TRIGO Group.

In fact, China continues to be the key player in the EV and battery component market as it dominates various steps of the battery supply chain, from material processing to the construction of cells and battery components. In this context of rising demand, it prompts an unprecedented level of investment and heightens the risk of disruption. According to the International Energy Agency (IEA), 35% of exported electric cars were from China in 2022 compared to 25% in 2021.

“In this context of rising demand, most OEMs and battery manufacturers plan to consolidate their production by building their own battery factories or by setting up joint ventures with one goal: setting up a resilient supply chain.” analyzes Augustin Brochot, EVP Innovation & Strategic Ventures at TRIGO Group.

Indeed, the most experienced battery manufacturers often encounter long delays in the start of production as well as delivery scale up. And in the ramp-up phase of production, larger than expected yield losses may occur due to machine shutdowns and lack of raw materials.

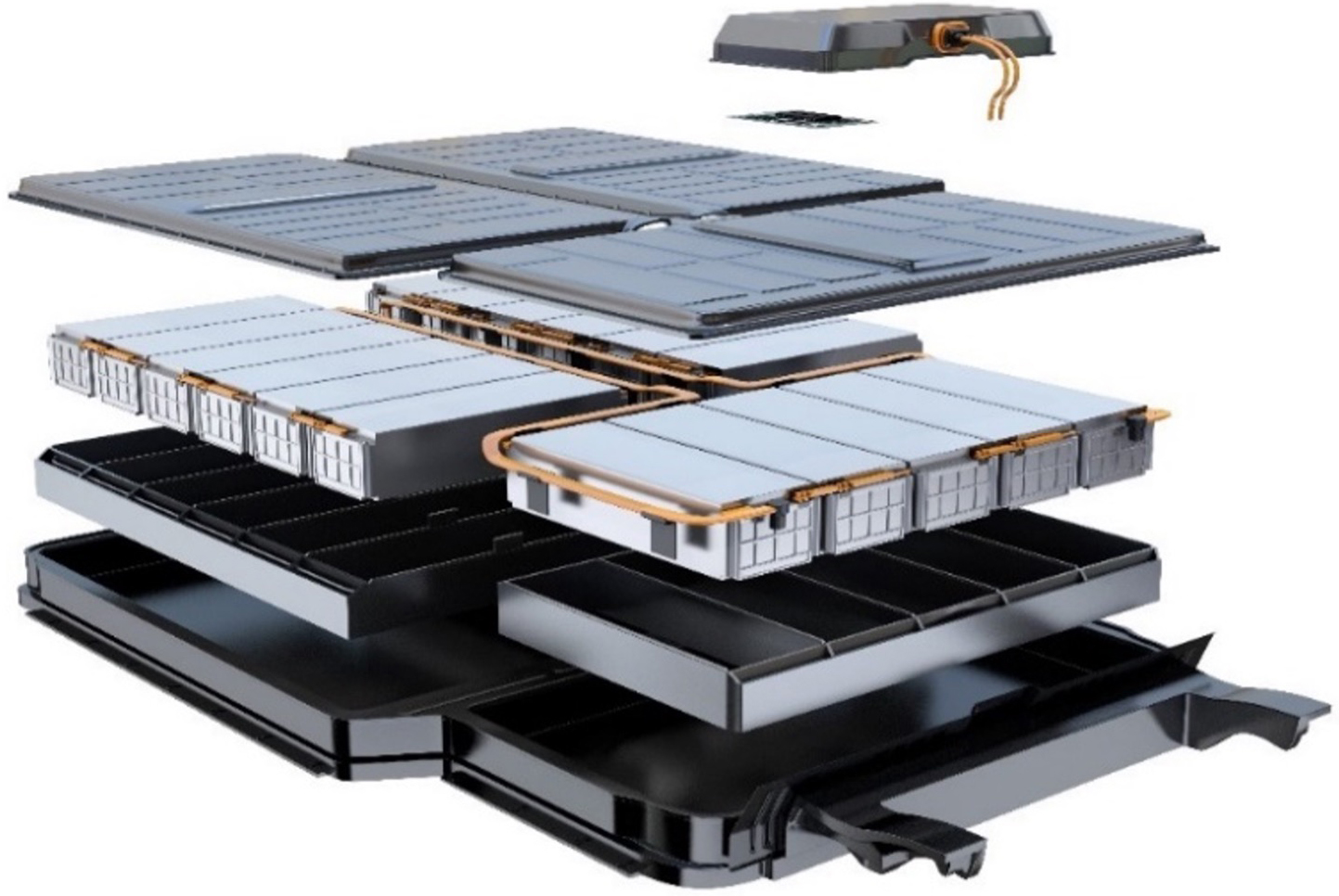

Exploded view of an electric vehicle’s battery pack/Stock

A critical mineral sourcing

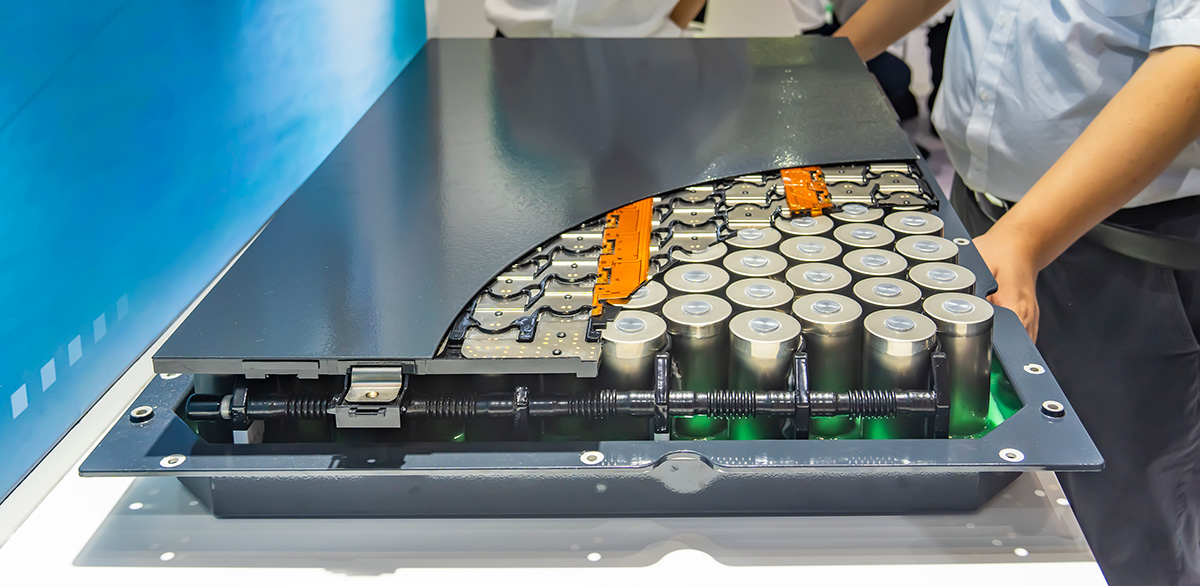

EV batteries are typically made up of several hundreds of rechargeable lithium-ion cells connected to form the battery pack. Lithium-ion cells tend to be the most used battery for electric vehicles thanks to their ability to store high-density energy, their cost efficiency and their low costs. They usually include lithium, cobalt, manganese, nickel and graphite.

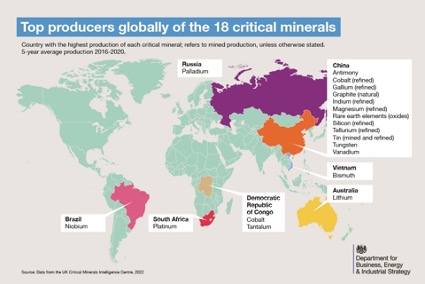

The production of batteries depends on the availability, extraction and processing of these raw materials needed to make batteries. In the coming years, the mining sector is expected to slow down, leading to supply chain and geopolitical crisis. For instance, nickel is currently in limited supply due to the conflict between Ukraine and Russia as Russia is the world's third-largest nickel producer, with 13% of mining capacity worldwide.

The supply of minerals among other raw materials for EV batteries are primarily mined in a very limited number of geographic areas and are highly concentrated. For each of the 18 critical minerals, the top three producer countries control between 73 and 98 percent of total global production. China is the biggest producer of 12 out of the 18 minerals. Australia, Brazil, the Democratic Republic of Congo, Russia, South Africa and Vietnam are the biggest producers of the remaining six. According to industry forecasts, 40% of lithium-ion battery demand is expected to come from China by 2030.

A highly tense skilled staff market to support the battery demand growth

Because of the exponential rise of the EV production, many of these professions are under high pressure and in short supply. This is one of the biggest challenges of this market, which is structuring itself. Indeed, competent, and productive workforce are key to operate a gigafactory. For instance, electrical engineers, chemistry specialists, quality engineers are key to succeed

The opening of new gigafactories will generate a variety of new jobs, from the production workers who assemble the batteries to the technician in quality and maintenance. Competences related to quality control, certification activities, compliance processes, testing, and inspection will be highly relevant. Indeed, highly skilled technical staff is fundamental at each step of the value chain:

-

in the pre-production phase: to meet quality standards and conformities and obtain the required quality certifications.

-

In the mass production phase: during manufacturing operations, qualified staff is key to secure battery production quality and boost efficiency to meet the high requirements on product, process, and environments. Engineers, technicians in quality maintenance are needed to support mass production and secure processes. It will also impact local labor demand, increasing their capability requirements.

-

in the aftersales with OEM’s, dealers and repair shops: to meet onsite quick diagnostics & failure mode analysis and simple repair. The technicians must be able to identify the root cause on the already launched vehicle. To make the changes in dealerships and repair shops, authorized personnel working on EVs and especially batteries need to be able to work on high voltage and intrusive battery diagnostic; this is also relevant to electrical and electronics flying doctors.

The presence of a skilled workforce especially when domestically based, not only supports the immediate production needs but also positions the gigafactory for sustained success and resilience in the face of industry challenges and advancements.

3 solutions to secure and maintain the quality of batteries through the value chain

To cope with these emerging problems and get a robust value chain, some key measures can be implemented:

1. Rely on the expertise and know-how of third party service providers to tackle the current value chain challenges

Relying on the expertise of third party service providers is an effective way to tackle the lack of staff that the sector has to face nowadays as well as the volatility and the fragmenting of the supply chain worldwide.

Therefore, companies like TRIGO intervene on two levels:

By training and upskilling OEMs and Tier 1&2 staff: TRIGO provides initial and continuous upskilling on Quality, Operational Excellence & ESG by strengthening skills and competencies related to battery quality management, and associated standards and legislation. Also by implementing outgoing testing & products validation thanks to its expertise. TRIGO also provides customized trainings based on standard & specific modules.

By providing qualified staff onsite, service providers are able to cope with the volatility and the fragmenting of the supply chain. Thanks to its Resident Engineer services, TRIGO act like a lubricant for the automotive industry by avoiding bottlenecks at every levels. Indeed, we advise, audit and train all stakeholders throughout the value chain in a preventive and reactive mode from the cell battery manufacturers to EV manufacturers and battery module manufacturers.

In a preventive mode, TRIGO provides a wide range of Consulting & Audit services towards battery stakeholders like trainings to adapt to the specificity of automotive industry. In a reactive mode, by providing some supplier development through a dedicated coaching.

TRIGO’s advantage is to be able to intervene with a qualified staff relevant to the current situation faced by the client in the pre-production phase, mass production phase and even in aftersales with OEM’s, dealers and repair shops.

2. Invest in stringent quality control measures during manufacturing

The foundation of a high-quality battery begins with manufacturing processes that prioritize precision and consistency. Implementing stringent quality control measures at every stage of production is crucial. This includes rigorous testing of raw materials, thorough monitoring of manufacturing processes, and comprehensive inspections of the final product.

Advanced technologies, such as machine learning and artificial intelligence, can be employed to analyze vast amounts of data in real-time, identifying and rectifying any deviations from quality standards. Additionally, investing in automation can minimize human errors and ensure that each battery meets the specified criteria for performance and safety.

3. Optimize the battery lifecycle management

Optimizing battery lifecycle management aligns with sustainability goals by promoting responsible resource utilization. Batteries contain valuable materials, including metals like lithium, cobalt, and nickel. Optimizing battery lifecycle management involves implementing proper recycling and disposal practices, reducing the environmental footprint of battery technologies. This contributes to the development of a circular economy where resources are used efficiently and waste is minimized.

While end-of-life battery management is not widely deployed, the solution to manage and ensure good quality battery management is to get analysis and diagnostics in a battery lab. At TRIGO, the Battery Clinic provides Battery testing, diagnostics, and analysis. This service enables to analysis and repair of suspicious batteries wherever it is in battery manufacturers or host in our sites.

Use Case: Enhancing Battery Pack Production and Traceability

As part of its collaboration with a leading French OEM, TRIGO contributed its expertise in quality management for electric batteries in one of the OEM’s sites in France.

TRIGO’s mission was to validate the battery packs for their release into service while awaiting the installation of the end of line bench (functional tests and battery pack power test). The functional burn-in procedure adapted by TRIGO has been supplied to the bench developer. The end of line bench is not yet operational for all types of batteries in automated tests, which are still validated manually by a TRIGO employee.

TRIGO provides technical support to analyze the internal functions via diagnostic requests or with development tools. Depending on the faults detected, battery packs can be quickly reworked.

To do so, we assigned Highly Voltage (HV) electricians to oversee the mission in the battery pack production workshop. Their expertise in high-voltage systems was essential for maintaining safety and quality standards throughout the production process.

What actions did TRIGO implemented?

TRIGO implemented a corrective plan declined in several steps as follows:

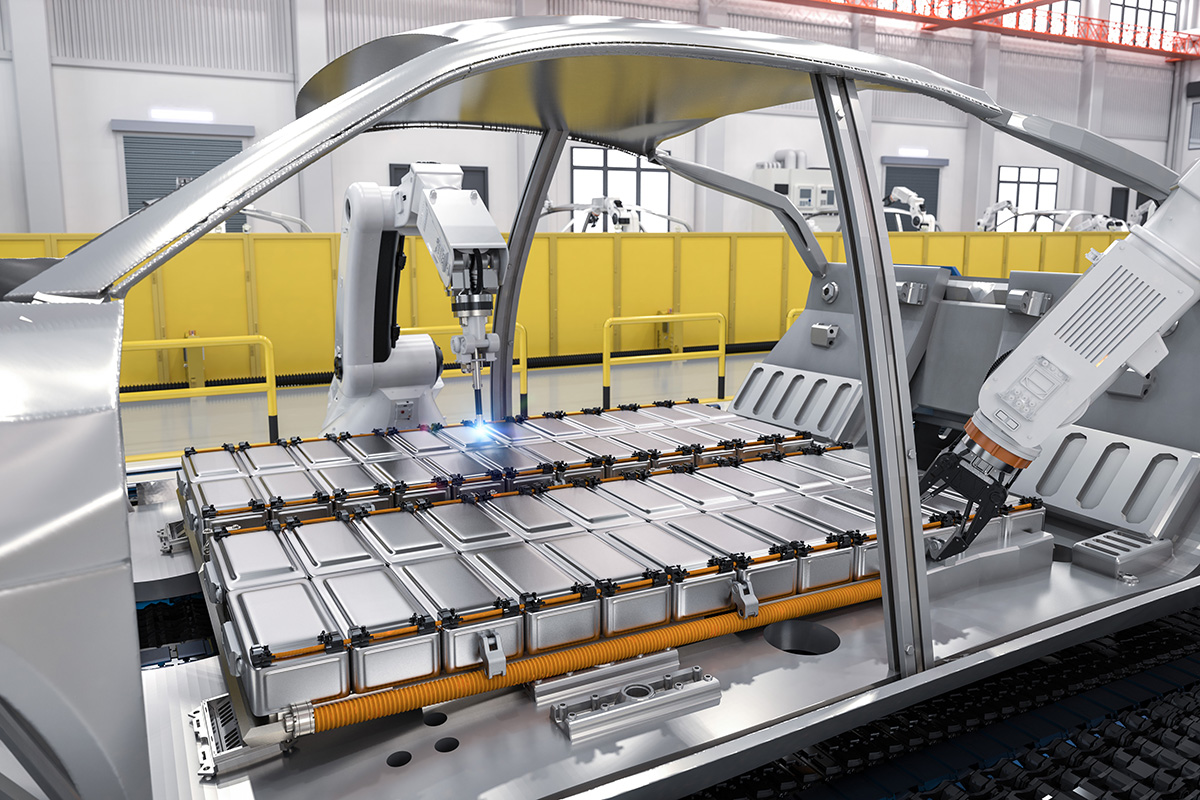

1. An Automated Assembly Battery Pack

We tracked the activities of an automated production line at an automotive factory site to increase the performance of high-quality battery packs.

2. Traceability Measures

We implemented dual traceability checks to ensure transparency and accountability. First, by introducing a direct traceability system on the battery pack product itself. Secondly, by integrating traceability measures within the OEM system, creating a comprehensive tracking mechanism from assembly to end-use.

3. Documentation Preparation

We developed detailed documentation for each battery pack, providing comprehensive information about the battery modules. This documentation will serve as a reference for quality control, maintenance, and customer support, contributing to overall product reliability.

4. End-of-Line Testing (EOL)

We supported a robust EOL testing process with two separate test benches located at the end of the pack assembly line.

As for the release process, we only approved battery packs that pass all EOL tests, ensuring that each unit meets the highest standards of power, functionality, and safety.

What is the outcome of this missions and key results?

- Production during line installation and ramp-up

- Enhanced traceability for improved quality control

- Comprehensive documentation for better maintenance and support

- Rigorous end of line testing ensuring reliability of each battery pack