Study’s motivation is to show and structure the role of quality service providers in the overall supply chain, focusing mainly on the automotive manufacturing sector.

Study’s approach is to identify the interface points between the supply chain and the quality activities by classifying various quality elements that impact supply chain performance.

The main reasons why manufacturers and suppliers entrust service providers may be: uneven or immediate resource demands; demand for independent third party; penalization; or just a need to avoid “familiarity blindness.” Moreover, service providers can bring full know-how with complex solutions for all the above issues.

Study uses another approach to identify the need for service providers. This is based on the fact that the Cost of Quality optimization never allows companies to reach 100% OK quality level. However, with the contribution of service providers, quality gaps can be covered on a reasonable cost level.

Study expounds the various levels of service providers’ integration from the lowest added value containment—e.g., sorting and rework—to the highest added value, supplier development.

Study points out that integrating highly educated and developed service providers would ultimately generate extra savings for all members of the supply chain, thus creating higher added value.

Keywords:

- timing; quantity; quality;

- soft and hard factors;

- supply chain vs. value chain;

- cost of quality;

- supplier development

Foreword: Context of Post-Industrialism

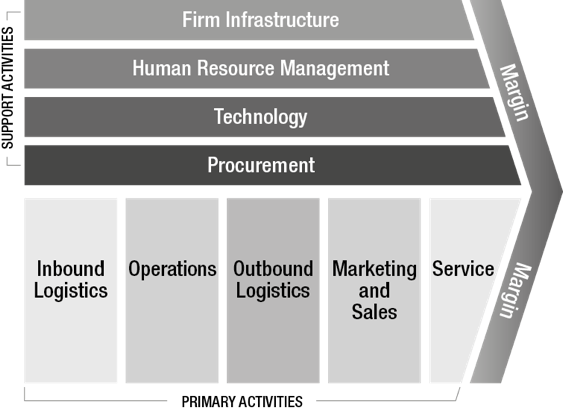

Accelerated information exchange in the knowledge-based society has dramatically changed the methods and structures of industrial production in the previous 25 years. Due to the geopolitical, economic, and communication changes taking place in the late 20th century, geographical borders do not limit the production and sales processes of the manufacturing sector any longer. The territorial expansion of the manufacturing supply chain has challenged the automotive industry to comply with a new-generation double customer demand, as automotive OEMs—at the same time—need to fulfill varying targeted customer needs, while providing high quality on each and every product globally. (Figure 1)

How is high quality feasible and sustainable in an industrial supply chain, where each and every supplying unit is integrated into a global network, and needs to conform with as many individual requirements as many part-customers they provide? Is there an ideal method to further optimize quality along the whole supply chain, or should the automotive industry settle for corrective quality actions ensuring continuous, protected assembly?

Figure 1: Supply Chain Model at TRIGO Group

Supply Chain vs. Value Chain—New Challenges in Quality

Whether comprehensive quality strictly means assembly-focused production support or a more holistic methodology adding value to an organization’s overall operation represent a post-industrial dilemma which can be accurately explained by the comparison of supply and value chain definitions.

“Supply chains require a multiplicity of relationships and numerous paths through which products and information travel. [. . .] To gain maximum benefit from the supply chain, a company must dynamically draw upon its available internal capabilities and the external resources of its supply chain network to fulfill customer requirements. This network of organizations, their facilities, and transportation linkages facilitate the procurement of materials, transformation of materials into desired products, and distribution of the products to customers.”[1]

Whereas the concept of supply chain pragmatically defines production as a set of processes targeting to fulfill customer requests, the value chain theory describes production as a core tool of a manufacturing unit to create its identity, thus reaching competitive advantage.

“A value chain is a set of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market. How value chain activities are carried out determines costs and affects profits.”[2]

Figure 2: Porter’s Value Chain Model

The value chain concept (Figure 2) reflects a postmodern paradigm, in which the fulfillment of customer requests is, of course, important to reach business goals, however, the long-term success of an organization is ensured by constantly creating new customer needs.

Within the framework of the value chain concept, the greatest contemporary challenge for the automotive industry quality is to redefine itself as a production-support tool, so that it does not only act along the procurement-production-distribution cycle, but also contributes to a manufacturing or supplying organization’s understanding how to develop their own identity, and achieve market advantage.

Extended Quality Scope

What are the actual drives behind the demand for extending quality along the automotive value chain?

Within the globalized supply chain, any failure or defect spreads immediately all over the world, while customer awareness is increasing, and any incident has immediate media coverage. This decade, most probably, will be introduced into the history of technology as the decade of automotive recall campaigns. Many of them did not only have broad media coverage, but substantial legal and financial consequences as well, which immediately impacted the manufacturing brand’s reputation too.

With the raising public awareness, customer expectations and consumer rights increase worldwide. Despite the coexistence of different legislations and compliance requirements in different geo locations, the (final) customer’s quality expectations - as pointed out before - are already getting more and more global. This does not only apply to the perceived quality, but also for the reliability of function, and for long term durability as well.

This tendency drives manufacturers (and brand owners) to have a fresh look at their quality management approaches, and cover the entire supply chain with appropriate quality management tools, systems, and processes that does not only serve manufacturing, procurement, and distribution, but also product development, supplier development, logistics, marketing, and sales, as well as after-sales services.

The predisposition for this kind of realignment of quality resources marks a significant progress in manufacturing towards the integration of value-added quality services - in the light of the value chain concept.

Quality in Value Chain Management

The contemporary realignment of quality resources also represents the fine line where pragmatic and holistic quality divide. In this sense, pragmatic quality - as a hard factor - directly influences the supply chain, while holistic quality complements the pragmatic approach - and as a soft factor - has indirect effects. (Factors, used as a terminology here, mean more than indicators, as they are linked to a group of several indicators, or more general descriptions of certain properties that cannot be measured directly.) In this approach, hard factors are the ones that have direct impact on the above mentioned supply chain indicators (quality, quantity, on time delivery, competitive price and service); while soft factors indirectly influence them. Many of the soft factors appear in value chain management only, generating cost and profitability effects first.

In order to be able to measure our supply chain performance, we need to identify the most important Key Process Indicators (KPI), and those need to be deployed from the customer’s perspective. What does the customer - in this case not only the final one, but all through the supply chain - expect? All customers expect that the materials (raw materials, components, and assembled parts) are delivered in time, in the ordered quantity and quality in competitive price.

Hard factors

For a better understanding, based on shop-floor experience, below lies a non-exclusive list of hard factors. Hard factors development impacts supply chain KPIs on: product quality, quantity, on time delivery, competitive price, and service.

Obviously, hard factors include product quality related quality solutions, such as: robust design (Poka Yoke design) and product inspection (from autonomous quality inspection to high level, integrated 100% detection methodologies), which can be implemented on incoming shipments or final products. Manufacturing process inspection - with all methods including statistical process control and error-proof processes - has also direct effect on product quality, therefore, should be classified as a hard factor.

Outside of the core manufacturing process, hard factors appear in the warehousing: JIT or SILS (or sometimes called value added assemble - VAA) centers. Typical factors in warehousing are: cleanliness and other environmental conditions, like temperature and humidity that may have to be maintained. Shelf life or rust prevention also impact product quality.

The protection of goods during transportation is a factor that is achieved by using appropriate packaging/dunnage, and, of course, careful handling.

Besides product quality, timing and quantity are also driven by above mentioned factors. First time quality (or direct run) will significantly impact capacity, and as a consequence, the delivery timing and quantity. Designing the process to achieve and maintain contracted Run@Rate by properly set tact time and well developed length of the supply chain is also a key factor. Well designed and applied packaging is important not only for product quality, but also to harmonize and balance right distribution, sequencing, and just-in-time (JIT) delivery.

There are many supply chain elements that may not be part of the mainstream processes. Those are supplementary or temporary activities generating further hard factors that may impact above KPIs. Voluntary or customer requested containment (so called controlled shipping), sorting and rework, for example, have direct influence on quality, quantity, and timing. In order to carry out effective containment, the method is to establish verification stations in the supply chain process. Those are typically implemented before or after shipping (or in some cases in separate warehouses). The intent is to protect the part-customer from nonconforming supplier-parts. Sorting, beyond differentiating OK and NOK parts according to specifications, is also to identify and group parts according to an agreed concession. So, even parts not meeting specifications, with agreed concession and known risk level, may become saleable. Rework contains already added value, since it puts non-saleable parts to saleable condition.

Elements:

- Raw Material & Supplier

- Demand Planning and Ordering - ERP Interface and EDI

- Delivery and Logistic Control

- Product Order and Follow-up

- Shippers’ Control

- Warehousing - condition control (Shelf Life Control)

- JIT Management

- SILS Management

- Characteristics Control

- Early Production Containment

- Controlled Shipping - Level 1 and 2, Sorting and Rework

- Define packaging concept and execute (manufacture or purchase packaging)

- Manage Packaging Flow

- Manufacturing

- Incoming Quality Control -

- Material Product Control - Delivery Window Management, warehousing, on line delivery, KANBAN, handling, etc.

- Product/Process Inspection

- Final Quality Control and Controlled Shipping

- Bogus Truck Control

- Distribution and Dealership

- Handling and customer hand-off

- Consumer

- Call-back Campaign

Soft factors

For a better understanding, based on shop-floor experience, below lies a non-exclusive list of soft factors. Soft factor development mainly impacts the following value chain KPIs: profitability, long-term market positioning, reputation, perceived quality rating, and long-term reliability.

As mentioned before, soft factors have no direct effect on quality, quantity, and timing, but indirectly influence them during product or process development, supplier development, quality planning, servicing, and the problem resolution phase. Non-exclusively, soft factors typically include: R&D with product and process validation, supplier selection (based on appropriate potential supplier assessment or evaluation of existing suppliers), supplier development, and supplier quality management from Advanced Product Quality Planning (APQP) through Production Part Approval Process (PPAP or VDA 2:PPA), internal and external problem solving methodology (8D) including root-cause analysis, corrective action implementation, and verification. Part identification, traceability control and label error proofing processes are essential—and must also be classified as soft factors. Other soft factors, in core manufacturing, are health, safety and ergonomic conditions, workplace organization (5S), value stream mapping and KAIZEN, change management and contamination control. HR development—especially training and recognition methods may also appear as value-added quality solutions, therefore, they are considered to be soft factors. Along the further upstream of the supply chain, it is important to name all methods and processes that are implemented to identify and evaluate market feedback and customer satisfaction regarding directly the product, as well as the distribution, dealers, shops, and other sales and aftersales services.

Elements:

- Product Development

- R&D

- Market Research

- Design & Development

- Product (Design) Validation and Testing (ADVP)

- Purchasing

- Strategic Development

- Supplier Selection

- Purchasing Footprint Development

- MRO (Maintenance, Repair and Operating Supplies or Indirect Material and Services Purchasing)

- Supplier Development/Quality Engineering & Supplier Quality Assurance

- Potential Supplier Assessment

- Suppliers Auditing and Certification

- Verify Supplier Quality Planning - Process Flow, PFMEA, Control Planning, Operator Instructions + including Error Proof systems

- PPAP

- Capacity Planning and Run@Rate auditing

- Early Production Containment (Safe Launch)

- Suppliers Performance Monitoring - Quality, Delivery

- Suppliers Quality System and Process Auditing - ISO/TS16949, VDA 6.1 or VDA 6.3, CQI-Technological Process Audits (Heat Treat-, Plating-, Coating-, Welding-, and Solder System etc.)

- Suppliers re-sourcing (in case poor performance)

- Change Management at Suppliers (including Business Transfer)

- Complaint Management - 8D

- Tool Management—life/quality monitoring, inventory check, financial control

- Inbound Logistics

- Develop Logistic Concepts

- Identification Requirements (product and shipping) - Label Standards & Label Error Proofing processes

- Manufacturing

- Value Stream Mapping - OEE

- Managing Change

- 5S

- Contamination Control

- Process Inspection

- Outbound Logistics

- HR Management

- HR Development and Training

- Reward and Recognition

- Marketing & Sales

- Market Research

- Customer Satisfaction Survey

- “Mystery Shopping”

- Service and Aftersales

- Warranty Monitoring

- Service Footprint

What Can Service Providers Do?

Above structure is a comprehensive listing of all items that are part of either supply chain management or - in a broader approach - value chain management. All of them are integrated into the contemporary quality management system (a.k.a. total quality management). As such, maybe not all elements, but most of them can be outsourced to a 3PL or 3PQ service provider. (The term, 3PQ [third party quality service provider] is analog to third party logistic service provider [3PL], and is used for the first time by the author. There are other abbreviations used, such as 3PQC or 3PQA, but those are applied for third party quality control or assurance only.)

Intention herewith is to introduce a new service methodology by identifying comprehensive and high added value quality servicing through the supply chain.

Let us identify those activities and management areas that a comprehensive 3PQ service provider can manage, therefore the players/members of the supply chain can outsource.

Taking automotive business as an example, R&D and product design is basically part of the core business of the OEMs and Tier 1s, though, validation process has several elements that can be (and already are) outsourced under appropriate control. There are several independent test laboratories and laboratories that are owned by various companies, but not utilized 100%. A 3PQ company, with networking, can coordinate underutilized test facilities, and can increase utilization by bringing validation job from other companies. Of course, all patent and competition issues have to be handled with high confidentiality, and under legal control and agreement. This is an excellent method to generate win-win situation and to make a lot of savings for all parties.

A lot of logistic elements of the process are already outsourced and managed by 3PL service providers, however, many of these processes are not purely logistic, as they cover quality aspects too. Product control and inspection are necessary in warehousing, JIT, or SILS centers, where 3PL and 3PQ service providers can work simultaneously on the same project. Any further product inspection in the supply chain - either at the end-process of the supplier, or at the receiving point - can be also outsourced to 3PQ in the form of controlled shipping or incoming inspection. As mentioned before, sorting and rework are also supplemental to the mainstream process, so entrusting a third party to deploy and manage them can be economically reasonable. Generally, all activities that are not typically part of the core business of the direct supply chain units, but have direct physical contact with the material belong to a 3PL and 3PQ service provider as their core business.

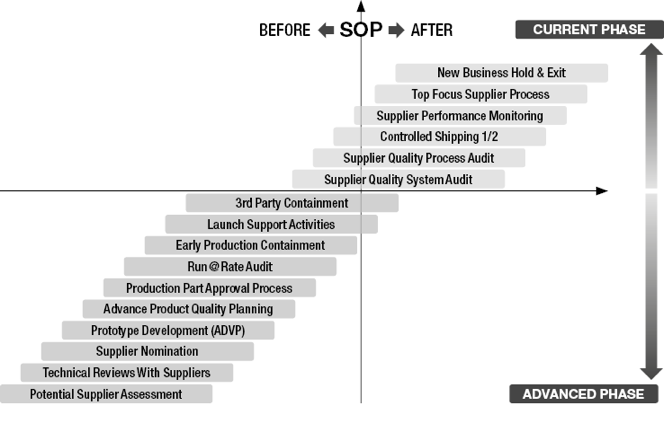

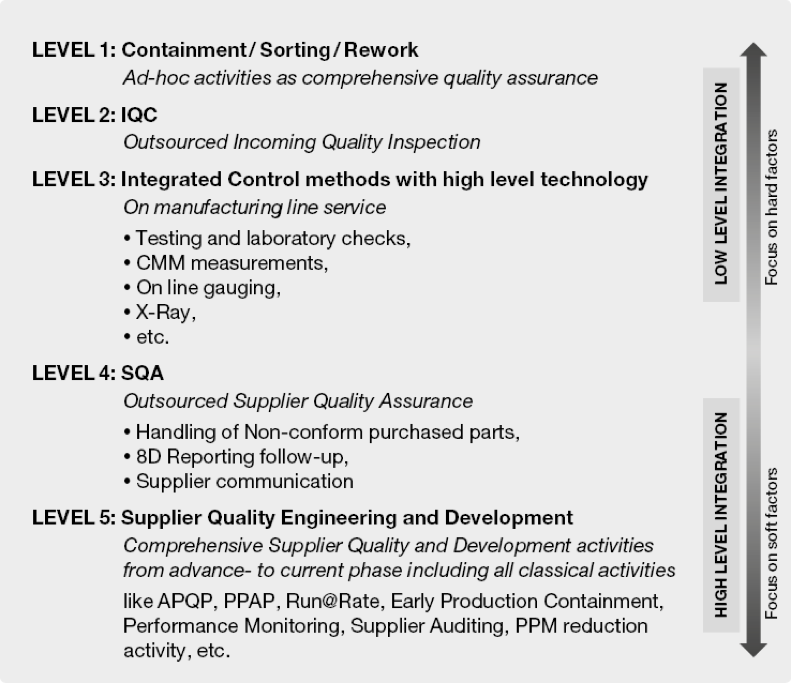

As mentioned before, there are higher value-added activities that can be outsourced as well. (Figure 3) Those are typically the ones that are linked to engineering activities on the OEM-supplier interface, or related to the OEM’s distribution flow. The quality steps diagram shows these typical activities and management elements which independent 3PQ can be involved in. Starting from supplier assessment to product approval (PPAP); from problem solving to suppliers certification, there are many activities that the key supply chain players may not want to, or may lack resources to manage, and might consequently outsource.

Figure 3: Service Provider’s Portfolio

Why Do Companies Involve 3PQ Service Providers?

Let us check, why companies in the supply chain entrust quality service providers! Manufacturing and supplying organizations may want to outsource activities, as:

- the activities are not part of the core business, and they do not want to deal with them;

- the organization lacks knowledge or know-how;

- they may face uneven demand needs or just periodic requirements;

- balance resourcing may be needed;

- immediate resources may be needed;

- it is necessary to avoid “familiarity blindness;”

- the customer insists third party involvement at supplier (e.g.: CS2) due to the loss of trust, or in order to simply leverage or penalize the supplier; and

- last, but not least, some organizations may look for complex solutions for their quality problems along the entire supply chain.

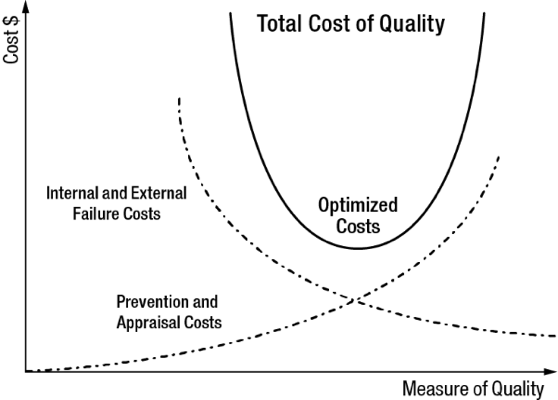

Cost of Quality

There is, however, another very practical reason, why companies entrust quality service providers. This is based on the cost of quality model. For a better understanding, we need to examine the relationship between cost and quality, and we need to understand the definition of “cost of quality.”

“Cost of quality is a means to quantify the total cost of quality-related efforts and deficiencies.”[3]

Basically those cost elements can be divided into 2 main categories:

- cost of control or conformance (prevention and appraisal cost), and

- cost of failure of control or cost of nonconformance (internal and external failure cost).

The first category can be usually planned and budgeted as a preventive cost, while the second category consists typical consequent cost - even with several non-tangible items. Generally, statistics show that the more companies spend on cost of conformance, the less they generate on cost of nonconformance. The total cost is the sum of those two categories.

Figure 4: Cost of Quality Optimization

The classical diagram (Figure 4) that we can use to form 2 factual statements:

- companies have to optimize their spending on the preventive side, and

- the consequent cost (failure cost) statistically will be never zero (especially not at the optimum).

At the initially calculated optimum Cost of Quality however there is a remaining gap that is likely not tolerated by the customer. As a consequence manufacturer has to make further efforts to eliminate this gap.

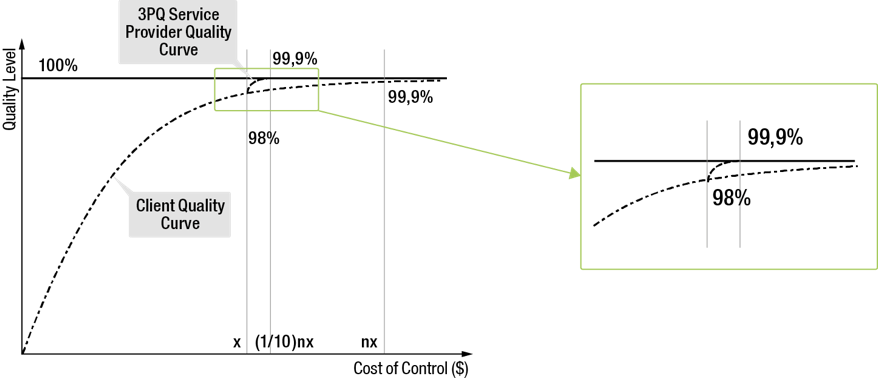

Figure 5: Manufacturer Quality Curve

Figure 5 shows the relation between cost of control (the money that the company spends on prevention) and quality results measured in % as quality level. The relation is exponential: as the company spends more money, the quality level is faster improving - though, it never reaches 100%. Therefore, even if the company spends 50- or 100% more on quality, the impact on the quality level improvement is substantially little - or less than expected, which means that there is no linear relationship between quality spending and results.

At the initially calculated optimum Cost of Quality the manufacturer may achieve (in our example) 98% quality level (spending “x” money for Cost of Control). The remaining 2% generates consequent cost which has been calculated this is less than spending further money on prevention. The customer expects zero failure. So, there are many non-tangible consequences that the classical Cost of Quality optimization is not counting with, like lost reputation and business. Though, manufacturer cannot afford (and financially not reasonable) to spend “n” times more money therefore has to find a way to bridge the gap. With the involvement of a 3rd party service provider (3PQ) this gap can be eliminated with a substantially less cost. Why? Because, for a 3PQ service provider, it is a well plannable cost (likely as a resource) with huge commitment and deliverable results. For the manufacturer at the same time, this may require further investments or an additional organization which will ultimately generate further cost unlikely to pay-off. If the company is delivered with this service by the provider, then this is a well-controlled cost, while the expectations can be clearly defined, and the 3PQ service provider performance can be measured too.

How this look like in our model? The 3PQ Service Provider quality curve starts at the point where the initially calculated optimum prevention cost vertical line cross the manufacturer’s (Client) quality curve. As this curve is also exponential at the starting point it will be very steep meaning that with a relatively low investment in control 3PQ will achieve significant result.

Does it mean that with 3PQ involvement 100% can be achieved? Likely not, but like in our instance targeting 99,9% quality level can be approached with significantly less invested cost. (E.g.: (1/10)nx vs. nx)

Figure 6: Service Provider Quality Curve Model

Levels of Quality Service Providers (3PQ) Integration

Considering many aspects like engineering capability, financial strength, market needs, resource availability, etc., the level of 3PQ involvement could be various. Usually, those service providers that are focusing on simple containment and sorting are the lowest level delivering relatively low margin, cheap solutions, low-level commitment, little complexity and customer lead. (This basically means nothing more than resource allocation with some coordination and with no or limited insurance and commitment.) They are focusing on influencing only hard factors. They are stepping into the supply chain and make some physical inspection. On the higher level 3PQ may be involved in Incoming-, In-process- or Final Quality Control with using maybe high level technologies. Those demand usually strong engineering background, still basically affecting hard factors. Though, there are complex 3PQ Service Providers with high added value engineering capability. Those are capable to manage Supplier Quality Assurance or Supplier Quality Development activities as outsourced method and thus have an impact on soft factors by leveraging the Value Chain.

The Role of the High Level Integrated 3PQ Service Providers in the Multi-Level Supply Chain

Due to the growing quality demands of the automotive market, the optimization and improvement of quality processes are essential along the supply and value chains. As leading OEMs and Tier 1s have responded to this demand by implementing their individual quality requirements (next to already existing global ones), all levels of the supply chain need to keep up with an ever-expanding scope of quality-related expectations, which, both from a professional and financial point of view, demands extra resources.

Manufacturing and supplying organizations have already realized that the integration of 3PQ is resourceful on the basic quality-related processes, such as sorting and rework. Empirical knowledge, however, shows that the more value-added the content of the quality solution delivery ordered from a quality service provider is, the more trust it takes from a customer to outsource it.

3PQ, on the other hand, has well planned processes, comprehensive know-how, and shop-floor experience to implement and manage solutions even more efficiently than the manufacturer or the supplier.

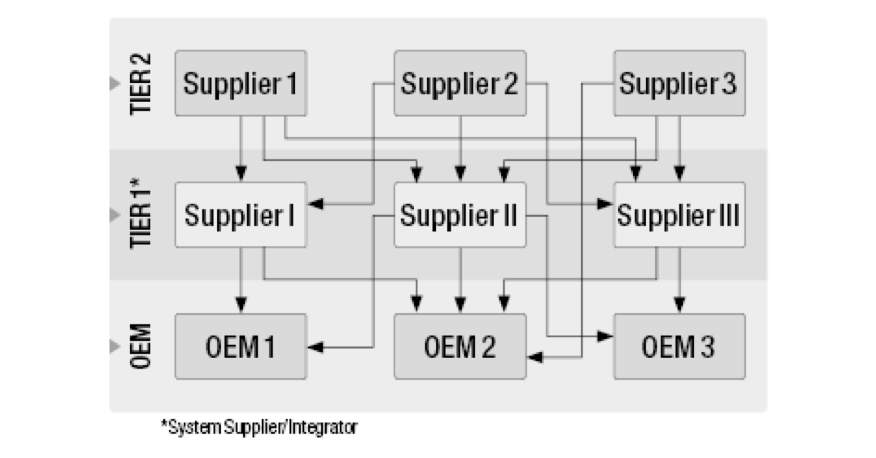

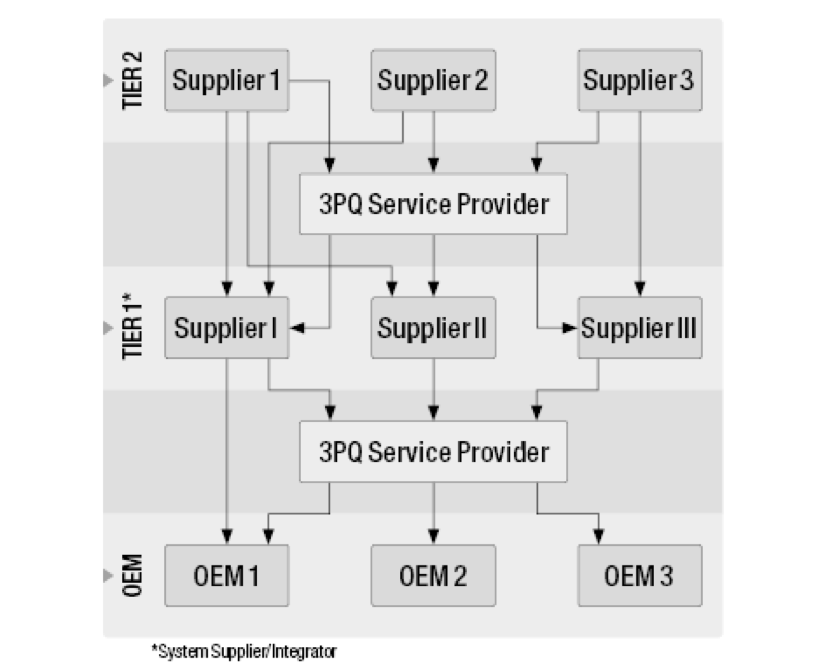

The future challenge of 3PQ is to explore the situation that on the different level of the supply chain almost each tiered supplier deliver to each customers that appear as either upper tiered supplier or final OEM customer. (Figure 7) Being integrated into the multi-level and multi-customer supply chain 3PQ Service Providers by using standardized international or even customer specific quality requirements, standards and know-how are able to eliminate the multiplication of resource involvement and as a consequence achieve substantial savings on each level and at each market player. (Figure 8) The key is to accelerate the development of existing partnerships with customers, and to reinforce links to clients, in order to get more trust invested. More trust means further insight to the customer’s strategic production (and market) goals, which 3PQ needs to efficiently translate into new quality solution improvements, whose application along the whole supply and value chains may step-by-step improve the whole automotive market’s competitive advantage.

Figure 7: Multilevel Supply Chain

Figure 8: 3PQ High Level Integration in the Multilevel Supply Chain

[1] Council of Supply Chain Management Professionals, edit., et al., The Definitive Guide to Integrated Supply Chain Management (Upper Saddle River: Pearson Education, 2014), 3–4.

[2] Michael E. Porter, Competitive Advantage: Creating and Sustaining Superior Performance (New York: The Free Press, 1985), Kindle edition.

[3] Feigenbaum, Armand V. , Total Quality Control (Harvard Business Review 34, November–December 1956), 6.

Attila Vass

TRIGO CEE LLC

HUNGARY

attila.vass@trigo-group.com